These thresholds consist of a minimum monthly volume of sales that the client agrees to factor.Īfter credit checks and analysis and based on debtors’ credit risk assessment, factors establish maximum purchase amounts and facility line limits. The collected amounts exceeding the required reserve amount are released to the client on an ongoing basis, typically once a week on a pre-agreed day.Ĭontracts typically stipulate minimum purchases. This reserve is cash collateral that the factoring company holds to protect its interests in the case payments cannot be collected, or other possible disputes arise.

#Factoring finance definition full#

Most contracts, especially the full recourse ones, authorize the factor to require and maintain a reserve amount.

Here you can find more information about factoring advances and their calculation. The difference between the purchase price and the advance minus fees and required reserve amounts is sent by the financial institution to the customer when the debtor pays.Īdvance rates, typically from 60% to 99%, tend to depend on the industry to which the client belongs. This money received upfront is not the total cash the client gets. That percentage multiplied by the purchase price is the upfront cash the client receives at the time of the accounts receivable purchase transaction. The advance is a percentage (rate) of the purchase price of outstanding invoices sold. Conditions vary from factor to factor, and our intention in this article is to detail the most widely found in the industry.Įach invoice’s purchase price is calculated by taking the original invoice’s face value and deducting all the discounts the client offers to the debtor. Please be aware that these are not necessarily the terms included in our contracts. In this section, you can find widely used factoring terms and conditions included in factoring contracts. Since the interest charged on loans from unorganized sector is normally very high, the businessmen are not very interested to avail of loan from this source.Typical Terms Included in a Factoring Contract Loans from Unorganized Sectorsīusinessmen always have the option to take the money from the moneylender (called indigenous bankers), friends and relatives.

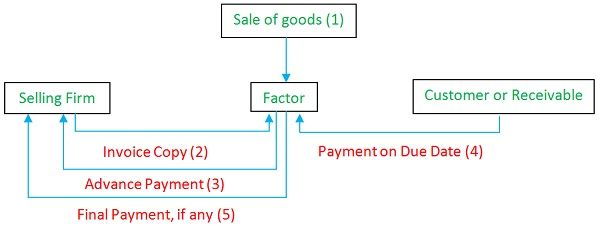

Sometimes businessmen insist his customers to make some advance payment as a part of the payment towards sale price of the product(s), which will be delivered at a later date. The advance finance provided by the factor firm is generally available at a higher interest cost than the usual rate of interest. This source is expensive when the invoices are numerous and smaller in amount. The client can concentrate on other functional areas of business as the responsibility of credit control is shouldered by the factor. It does not create any charge on the assets of the firm. It provides security for a debt that a firm might otherwise be unable to obtain. Flexible:įactoring as a source of funds is flexible and ensures a definite pattern of cash inflows from credit sales. With cash flow accelerated by factoring, the client is able to meet his/her liabilities promptly as and when these arise. Obtaining funds through factoring is cheaper than financing through other means such as bank credit. In this case the business shifts the responsibility of collecting the outstanding amount from the debtors on payment of a specified charge and can take advance money from the bank against the amount to be realized from the debtors.

0 kommentar(er)

0 kommentar(er)